Have you ever wondered how businesses keep track of their profits and expenses? If you’re diving into the world of finance or running your own company, understanding an income statement is crucial. This financial document tells a story—the story of how money flows into and out of a business. income statement example But what exactly does an income statement look like? Let’s break it down with a practical example.

The Basics of an Income Statement

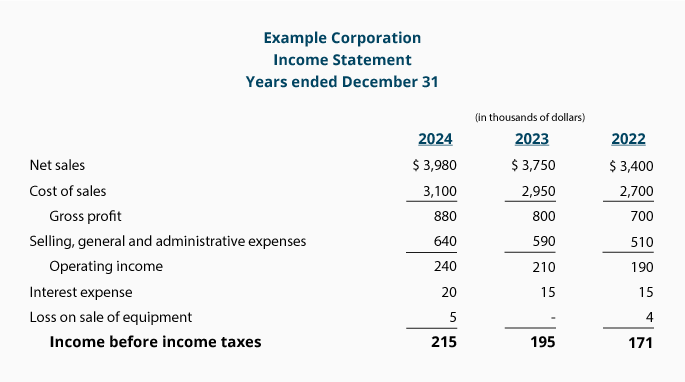

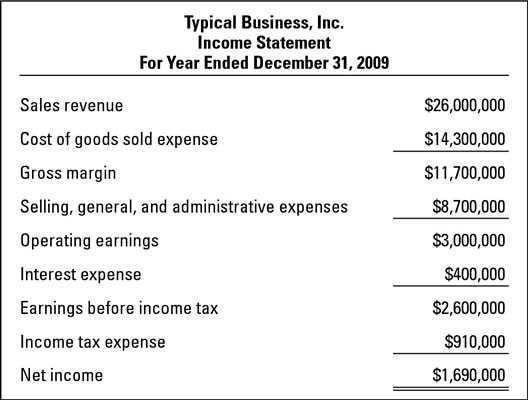

An income statement, also known as a profit and loss statement, provides a snapshot of a company’s financial performance over a specific period. It details revenues, expenses, and the resulting net profit or loss. This document is essential for assessing a company’s profitability and is income statement example often used by business owners, investors, and financial analysts.

The structure of an income statement usually includes:

- Revenue (or Sales): The total income generated from business operations.

- Cost of Goods Sold (COGS): Direct costs related to producing goods or services sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs incurred during regular business operations (e.g., salaries, rent, utilities).

- Operating Income: Gross profit minus operating expenses.

- Other Income and Expenses: Items like interest, taxes, or one-time gains/losses.

- Net Income: The final profit or loss after accounting for all expenses.

Now that we’ve covered the basics, let’s dive into an example.

An Income Statement Example for a Small Business

Imagine you own a coffee shop called “Brew Haven.” You want to know how your shop performed financially in the last quarter. Here’s how your income statement might look:

Revenue

Brew Haven generated $50,000 in sales during the quarter. This amount includes all the money customers spent on coffee, pastries, and merchandise.

Cost of Goods Sold (COGS)

To make those delicious lattes and croissants, you spent $15,000 on ingredients like coffee beans, milk, sugar, and flour. This is your COGS.

Gross Profit

To calculate gross profit, subtract COGS from revenue:

$50,000 (Revenue) – $15,000 (COGS) = $35,000 (Gross Profit)

This figure shows how much money is left after covering the direct costs of producing your products.

Operating Expenses: Breaking It Down

Running a coffee shop comes with additional costs. These are your operating expenses:

- Rent: $5,000

- Salaries: $10,000

- Utilities: $2,000

- Marketing: $1,000

- Miscellaneous: $1,000

The total operating expenses amount to $19,000. These costs are necessary to keep your business running but are not directly tied to the production of goods.

Operating Income

Subtract operating expenses from gross profit to find your operating income:

$35,000 (Gross Profit) – $19,000 (Operating Expenses) = $16,000 (Operating Income)

This number indicates how much money your business made before income statement example considering taxes and other non-operational items.

Accounting for Other Income and Expenses

Let’s say Brew Haven earned $500 from selling an old coffee machine. However, you also paid $1,500 in interest on a business loan. These are categorized as other income and expenses.

Net Income

Finally, calculate your net income by adding other income and subtracting other income statement example expenses from your operating income:

$16,000 (Operating Income) + $500 (Other Income) – $1,500 (Other Expenses) = $15,000 (Net Income)

This is your coffee shop’s profit for the quarter. Not bad, right?

Why Is an Income Statement Important?

Understanding an income statement isn’t just for accountants. It’s a income statement example vital tool for anyone involved in business. Here’s why:

Assessing Profitability

An income statement shows whether your business is making money. By analyzing revenue and expenses, you can identify trends and make informed decisions to improve profitability.

Budgeting and Planning

Looking at past income statements helps you create accurate budgets.income statement example You can allocate resources more effectively and set realistic financial goals.

Attracting Investors

Potential investors want to see your income statement to assess your business’s financial health. A solid profit margin and steady revenue growth can make your company more appealing.

Managing Expenses

An income statement highlights areas where you might be overspending. income statement example For example, if operating expenses are too high, you can find ways to cut costs without sacrificing quality.

Tips for Creating Your Own Income Statement

If you’re ready to create an income statement for your business, follow these steps:

- Gather Financial Data: Collect all revenue and expense records for the period you’re analyzing.

- Organize Your Information: Categorize data into revenue, COGS, operating expenses, and other items.

- Use Accounting Software: Tools like QuickBooks or Xero can simplify the process and reduce errors.

- Review Regularly: Update your income statement monthly or quarterly to stay on top of your finances.

Final Thoughts

An income statement might seem intimidating at first, but it’s income statement example a powerful tool for understanding your business’s financial performance. By breaking down the numbers, you gain valuable insights that can guide your decisions and help your business thrive. income statement example Whether you’re running a cozy coffee shop or a tech startup, mastering this financial document is a step toward success.

So, are you ready to create your own income statement? Start with a simple example, like Brew Haven, and watch how the numbers reveal your business’s story.

About The Author

You may also like

-

Target Credit Card Login for Men: A Complete Guide

-

Exploring the Macon Telegraph: A Pillar of Journalism in Georgia

-

Exploring alan tudyk left eye Left Eye: The Actor’s Unique Trait

-

Exploring the Delicious World of Geek Bar Flavors

-

Exploring the New Balance 9060: The Perfect Blend of Comfort and Style